Did you know that every year, about one in five pet owners in the US deal with unforeseen medical bills? Pet insurance may save lives, but it’s important to know its restrictions.

Although it’s not always the case, many pet owners believe that everything is covered by their insurance policy. Limitations and exclusions may result in unforeseen costs for you.

You may make more educated choices about your pet’s medical treatment if you are aware of the insurance exclusions. To assist you understand what to anticipate from your coverage, we’ll go over the typical restrictions and limits found in pet insurance plans in this post.

Typical Exclusions from Pet Insurance Coverage

It’s critical to comprehend pet insurance restrictions in order to make well-informed choices about your pet’s medical treatment. Although they don’t cover everything, pet insurance plans are designed to help with unforeseen veterinary costs.

To prevent unpleasant surprises while submitting a claim, it is crucial to understand what is often not covered by pet insurance. Common exclusions fall into a number of general categories.

Conditions that already existed

Pre-existing conditions are often not covered by pet insurance coverage. This implies that you will not be able to make a claim for a medical condition that your pet has if it exists before you get insurance or before the policy’s waiting period expires.

Pre-existing conditions include, for example:

- Chronic diseases such as diabetes or arthritis

- Prior wounds, such a torn ligament

- Chronic ailments such as skin infections or allergies

Preventative and Routine Care

Your pet’s health depends on routine and preventive care, but these costs are often not covered by most pet insurance plans. This may include routine checkups, dental care, and vaccines.

If you think regular treatment is necessary, it’s worth looking into the extra or optional coverage that some insurance companies give for these services.

| Routine Care | Average Annual Cost |

|---|---|

| Vaccinations | $50-$100 |

| Dental Care | $300-$700 |

| Regular Check-ups | $50-$200 |

Hereditary and Breed-Specific Conditions

Breed-specific and genetic illnesses may not be covered by some pet insurance plans, particularly if they are deemed high-risk. For instance, the genetic composition of certain breeds makes them susceptible to particular health problems.

Among the examples are:

- German Shepherds and other big dogs may have hip dysplasia.

- Heart problems in bulldog and other breeds

- Eye issues in Poodles and other breeds

Elective and Cosmetic Procedures

Pet insurance often does not cover elective or cosmetic operations. Cosmetic surgery, ear clipping, and tail docking are a few examples.

You may choose a pet insurance coverage with more knowledge if you are aware of these typical exclusions. To be sure you’re obtaining the coverage that best meets your pet’s requirements, always go over the policy specifics and ask questions.

Recognizing the Restrictions and Limitations of Policies

The secret to avoiding unpleasant surprises when submitting a claim is to read the small print of your pet insurance policy. Pet insurance plans are intended to help cover the cost of your pet’s medical care, but many include limits and limitations that may affect your coverage.

Waiting Times

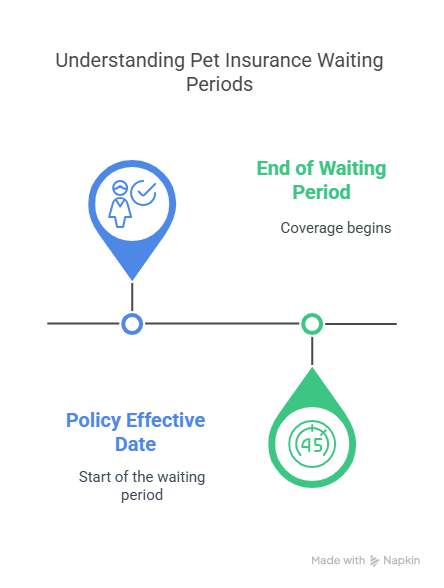

The waiting time linked to your pet insurance coverage is an important consideration. The interval between the policy’s effective date and the actual start of coverage is known as the waiting period. Even if your pet is injured or has a disease during this period, you are not permitted to make a claim. Insurance companies have different waiting periods, so it’s important to review the details of your policy to prevent any confusion.

For example, waiting periods for accidents may be shorter under some regulations than those for sickness. Knowing these specifics can help you prepare and make sure you don’t be caught off guard when it comes time to submit a claim.

Deductibles and Coverage Caps

Your policy’s deductibles and coverage limitations are additional crucial considerations.The maximum amount that an insurance company will pay out for a claim or throughout the course of the policy is known as a coverage cap. Conversely, deductibles are the sums of money you have to pay out of cash prior to the start of your insurance coverage.

For instance, you will be responsible for paying the first $500 of your pet’s medical bills if your policy has a $10,000 annual coverage maximum and a $500 deductible. The insurance would then pay up to $10,000 for the remainder of the year. Comprehending these numbers is essential for controlling your expectations and making financial plans.

Limitations on Age

Another restriction that may impact your pet insurance coverage is age. Pet enrollment is subject to age restrictions from many insurance companies, and others may not cover pets past a certain age. When choosing an insurance, it’s critical to review the age limitations, particularly if you have an elderly pet.

Policies for elderly dogs may be available from some insurers, but they may have lower coverage or higher costs. You may choose your pet’s insurance coverage more wisely if you are aware of these age-related restrictions.

To sum up, it’s important to comprehend the terms and conditions of your pet insurance policy, such as waiting periods, coverage quotas, deductibles, and age restrictions, in order to make sure you’re ready for your pet’s medical requirements. You can maximize the benefits of your pet insurance and steer clear of any problems by carefully reading the tiny print and asking the correct questions.

Conclusion: Choosing Pet Insurance With Knowledge

It’s essential to comprehend pet insurance restrictions in order to make well-informed choices about your pet’s medical treatment. Pre-existing conditions, regular and preventive treatment, and breed-specific conditions are examples of typical exclusions, as we have described. Furthermore, your coverage may be greatly impacted by insurance restrictions including waiting periods, coverage ceilings, and deductibles.

Selecting a coverage that fits your pet’s requirements might be made easier if you are aware of the non-covered services and possible disadvantages of pet insurance. You may make appropriate plans and steer clear of unforeseen veterinary expenditures by being aware of what is not covered. Examine the small print and inquire about any exclusions or limits when choosing a pet insurance plan.

You may make an educated choice and provide your pet the best care possible by researching and comprehending the limits of pet insurance. With this information, you can make sense of the complicated world of pet insurance and be ready for any unforeseen veterinary bills.