In the United States, owning a pet entails treating your animal companion as family rather than just a friend. However, unforeseen veterinary costs might put a burden on your finances. That void is filled by pet insurance, which provides a safety net for both you and your animal friend.

Understanding dog insurance may seem overwhelming, but it’s essential to ensure your pet receives the care they need without going over budget. In short, it’s a kind of insurance that helps cover the costs of your dog’s medical care. This coverage allows you to make educated decisions about your pet’s health without having to worry about unanticipated expenses.

As we go over the intricacies of dog insurance, you’ll learn what to expect and how to get the most out of your pet insurance policy.

How Do Dog Insurance Plans Work?

Dog insurance is a crucial investment for pet owners who want to ensure their beloved friends get the best care possible without going over budget.

By helping pet owners handle their dogs’ vet costs, dog insurance programs are designed to protect pet owners from unanticipated medical expenses.

Types of Coverage Plans Available

There are many types of dog insurance plans, and each has different levels of coverage.

- Accident-only coverage: These plans cover things like broken bones and food that has been consumed.

- Comprehensive insurance: These policies cover accidents as well as conditions like arthritis or allergies.

- Wellness plans: These programs provide routine medical care, such as dental cleanings and vaccinations.

Understanding the different plan types may help you choose the best coverage for your dog.

Which Medical Expenses Are Typically Covered

Dog insurance often covers a range of medical expenses, such as:

| Expense Type | Description | Typical Coverage |

|---|---|---|

| Diagnostic tests | Tests to diagnose medical conditions, such as X-rays or blood tests | Yes |

| Surgical procedures | Surgery to treat medical conditions, such as tumor removal or orthopedic surgery | Yes |

| Medications | Prescription medications to treat medical conditions | Yes |

| Hospitalization | Costs associated with hospitalizing your dog | Yes |

The cost of pet insurance depends depend on the kind of plan and provider you choose.

Typical Wait Times and Exclusions

Common exclusions include:

- Conditions that existed before the policy was put into effect are known as pre-existing conditions.

- Breeds or conditions: Some breeds or conditions may not be covered.

Additionally, you may not be able to submit claims for certain diseases or accidents during waiting periods.

Getting the Most Out of Dog Insurance

Knowing how to get the most out of dog insurance may have a big influence on both your financial security and the health of your pet. Understanding the nuances of dog insurance is crucial if you want to get the most out of your investment.

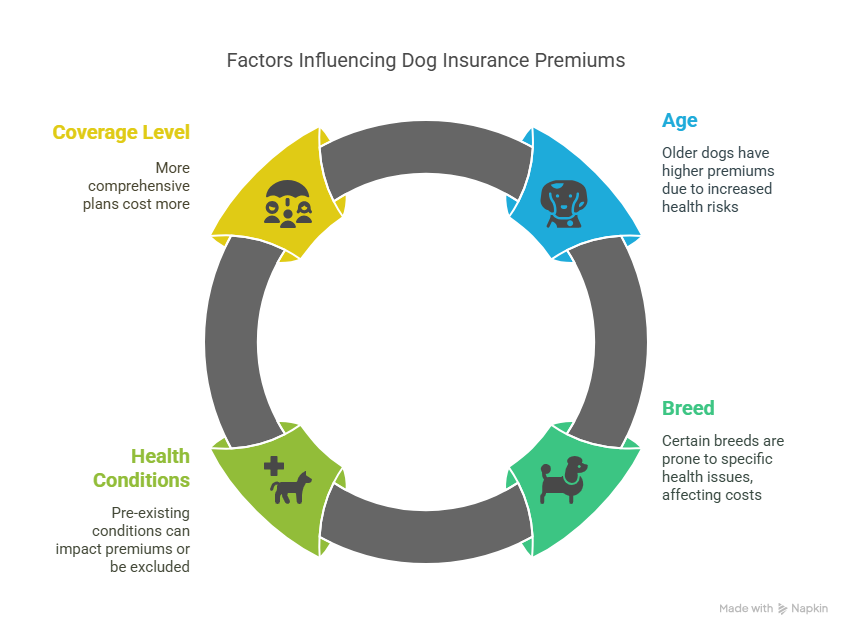

Factors Affecting Your Premium Prices

The age, breed, health, and level of coverage of your pet are some of the elements that affect the cost of dog insurance premiums.

- Age: Because of the increased risk of age-related health problems, older dogs usually have higher insurance premiums.

- Breed: Premium prices may be impacted by a breed’s propensity for certain health issues.

- Health Conditions: You may be excluded from coverage or have your premium affected by pre-existing conditions.

- Coverage Level: More expensive are more comprehensive plans with greater reimbursement rates and lower deductibles.

Selecting a dog insurance plan that meets both your pet’s requirements and your budget may be made easier if you are aware of these aspects.

How to Evaluate Plans and Choose the Best One

To make sure you get the greatest coverage for your pet, comparing dog insurance policies entails weighing a number of important factors.

| Plan Features | Basic Plan | Premium Plan |

|---|---|---|

| Deductible | $200 | $100 |

| Reimbursement Rate | 70% | 90% |

| Annual Limit | $5,000 | $10,000 |

By comparing these features, you can identify the plan that offers the best pet health insurance benefits for your situation.

Making Claims and Receiving Payment

Usually, filing a dog insurance claim is sending the insurer your veterinarian expenses so they may compensate you.

- Ask your veterinarian for a comprehensive invoice.

- Complete the claim form that your insurance company has given you.

- Send the invoice and claim form to the insurance company.

- Await claim processing and reimbursement from the insurer in accordance with your policy.

You may use the system more effectively and make sure you get the refund you’re due if you understand this procedure.

When Investing in Dog Insurance Is Worth It

If your pet has chronic health problems or you’re worried about the possibility of expensive medical expenses, dog insurance is well worth the price.

The assurance that comes from knowing they can afford to provide their dogs the medical treatment they need is priceless to many pet owners.

Conclusion

For pet owners who want to guarantee that their furry companions get the finest medical treatment possible without going over budget, dog insurance is an essential investment. It’s essential to comprehend how dog insurance works in order to make wise choices regarding the wellbeing of your pet.

Selecting the appropriate coverage plan can save your dog from unforeseen medical costs. It’s important to evaluate and choose a dog insurance plan that fits your requirements and budget since different policies differ in terms of coverage, premium fees, and exclusions.

Essentially, dog insurance gives you peace of mind and financial stability so you can concentrate on what really matters—the health and welfare of your pet. You can maximise your investment and provide your dog with the care they need if you understand how dog insurance works.