Did you know that for many pet owners in the US, veterinarian expenditures may be a major source of financial hardship? Unexpected veterinary appointments may sometimes cost hundreds or even thousands of dollars, according to a recent study.

Pet owners who want to make sure their furry pals get the finest treatment possible without going over budget must understand how much pet insurance costs. You may save yourself from financial shocks brought on by unforeseen veterinarian bills by getting the appropriate insurance coverage.

Knowing the elements that affect pet insurance rates and how to choose the best plan for your requirements is crucial for responsible pet owners. We’ll go over the specifics of pet insurance in this post so you can make well-informed choices about the health and welfare of your pet.

Recognizing the Cost of Pet Insurance

Making educated judgments about your pet’s medical treatment requires knowing how much pet insurance costs.Understanding the elements that affect pet insurance prices is crucial since they may vary significantly depending on a number of factors.

Pet insurance costs are usually divided into a number of parts, such as coverage limitations, deductibles, and average monthly premium rates. Let’s examine these components in more detail to see how they affect the total cost.

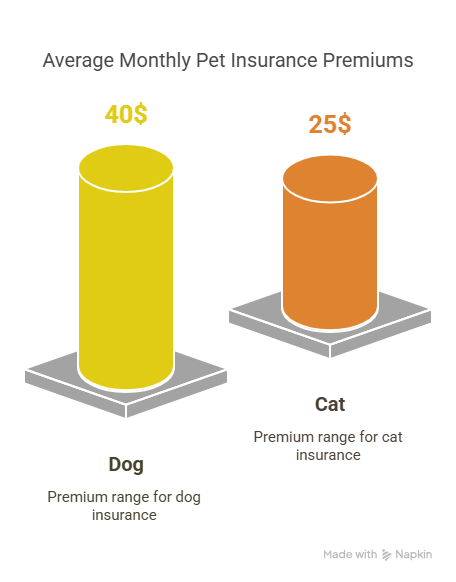

Average Monthly Premium Prices

Pet insurance premiums might vary greatly on an average monthly basis. For example, a dog’s monthly insurance premium may range from $30 to $50, but a cat’s monthly insurance premium may be between $20 and $30. These are just estimates, however, and real expenses may differ depending on the breed, age, and health of the pet.

A young dog in good health, for instance, would pay less for insurance than an elderly dog with a history of health problems. Finding the best insurance rates for your cat requires comparing quotes from many insurance companies.

Limits on Coverage and Deductibles

Two important factors that influence the price of pet insurance are deductibles and coverage limitations. The amount you must pay out of pocket prior to your insurance taking effect is known as your deductible. In general, monthly rates for policies with greater deductibles are cheaper than those for plans with smaller deductibles.

Conversely, coverage limitations establish the highest sum that the insurance will cover for your pet’s medical bills. Depending on the policy, annual coverage limitations might be anything from $5,000 to infinity. Selecting the appropriate deductible and coverage level is essential to preventing unforeseen veterinarian expenses from taking you by surprise.

To make sure you’re protected for recurring costs, you may want to choose a greater coverage level, for example, if your pet has a chronic illness. On the other hand, a lesser coverage level could be enough if your pet is typically healthy, which might result in reduced costs.

Factors Influencing the Cost of Pet Insurance

Finding the best coverage for your pet and comparing pet insurance rates may be made easier if you are aware of the elements that influence pet insurance price.

Considerations for Pet Breed and Age

Your pet’s breed and age have a big influence on insurance costs.

The likelihood of health problems in older dogs raises rates.

Insurance rates are impacted by the health issues that certain breeds are more likely to have.

Options for Coverage and How They Affect Prices

Your pet insurance rate is directly impacted by the coverage level you choose.

Comprehensive policies offer wellness care, while basic plans cover accidents and injuries.

Premiums rise when optional coverage is added, such as dental care or alternative treatments.

Take your pet’s demands into account while selecting a plan in order to get reasonably priced pet insurance quotes.

Location-Related Price Differences

Due to regional laws and variations in the cost of veterinary treatment, pet insurance rates varies by area.

Premiums are often greater in urban regions than in rural ones.

| Location | Average Premium |

|---|---|

| Urban Areas | $50-$75/month |

| Rural Areas | $30-$50/month |

Searching for the Best Prices by Comparing Suppliers

Investigate and contrast quotations from many pet insurance companies to compare prices efficiently.

Think about things like reimbursement rates, deductibles, and coverage restrictions.

Premiums may also be lowered by yearly payments or discounts for many pets.

You may obtain the finest prices and reasonably priced pet insurance quotes for your pet by comparing suppliers.

Finding the Best Pet Insurance for Your Budget: A Conclusion

Making educated judgments about your pet’s medical treatment requires knowing how much pet insurance costs. You may discover an insurance that offers the ideal combination of price and coverage by taking into account variables like your pet’s age, breed, and health requirements in addition to your financial situation.

The degree of coverage, deductible, and provider are just a few of the variables that affect how much pet insurance costs. It’s important to evaluate the coverage choices and compare prices offered by several insurance providers, like Nationwide, Trupanion, and PetPlan, in order to choose the best policy for your budget.

Keep in mind that lower isn’t always better when comparing pet insurance quotes. Seek for an insurance plan that provides full coverage, affordable premiums, and fair deductibles. You can make sure your pet gets the care they need without going over budget by doing this.

The cost of pet insurance is ultimately a personal choice that is influenced by both your financial status and the particular requirements of your pet. You may provide your pet the protection they need by carefully weighing your alternatives and selecting a policy that fits within your means.