Did you know that in order to protect their dogs’ health without going over budget, millions of pet owners in the US are now choosing reasonably priced pet insurance? It is now crucial for pet owners to think about financial protection solutions due to the growing expenses of veterinary treatment.

Ten dollars a month for pet insurance sounds like a tempting option to many. However, what does it really involve? Pet owners who want to make sure their animals get the care they need without breaking the bank are increasingly choosing this cost-effective solution.

Knowing the ins and outs of $10 a month pet insurance policies is essential given the ongoing growth in veterinary expenses. To assist you in making an educated choice on the medical treatment of your pet, let’s examine the specifics.

What $10 a Month Pet Insurance Actually Covers

Pet owners should be aware of the exact coverage specifics of inexpensive pet insurance policies, such those that cost $10 per month. These plans provide a basic degree of pet protection and are designed to be affordable.

Simple Accident-Only Defense

Generally, pet insurance that costs $10 per month only covers accidents. This implies that insurance pays for expenses related to unforeseen mishaps, such injuries sustained in auto accidents, animal conflicts, or ingesting toxic materials. For example, this kind of insurance may assist in paying for the veterinarian bills in the event that your pet consumes anything poisonous and needs immediate surgery.

Deductibles and Coverage Limits

It’s important to realize that inexpensive pet insurance policies sometimes include larger deductibles and less coverage. For instance, a plan may have a $250 deductible yet cover up to $1,000 in veterinarian costs. This implies that before the insurance starts to pay, you would have to pay the first $250 out of pocket. Furthermore, certain plans could include a reimbursement rate, which means that once the deductible is paid, a portion of the costs are covered.

Pet owners should carefully examine the coverage limitations, deductibles, and reimbursement rates of any pet insurance coverage plan they are contemplating in order to make an educated choice. This will make it more likely that the selected plan will satisfy their pet’s requirements without breaking the bank.

Pet insurance companies that provide plans for $10 per month

In the US market, a number of low-cost pet insurance companies have surfaced, with coverage starting at $10 per month. These businesses serve pet owners who want to make sure their animals get the care they need without going over budget.

Affordable Suppliers in the US Market

Known for their extensive coverage and adjustable price structures, Trupanion and PetPlan are a few of the prominent suppliers.PetPlan gives coverage for diseases, accidents, and even regular care, while Trupanion’s basic plan offers limitless medical coverage for dogs.

A variety of coverage choices and reasonable prices are also provided by other carriers, such as Healthy Paws and PetFirst.PetFirst has a variety of deductible alternatives to accommodate varying budgets, while Healthy Paws is renowned for its limitless lifetime benefits.

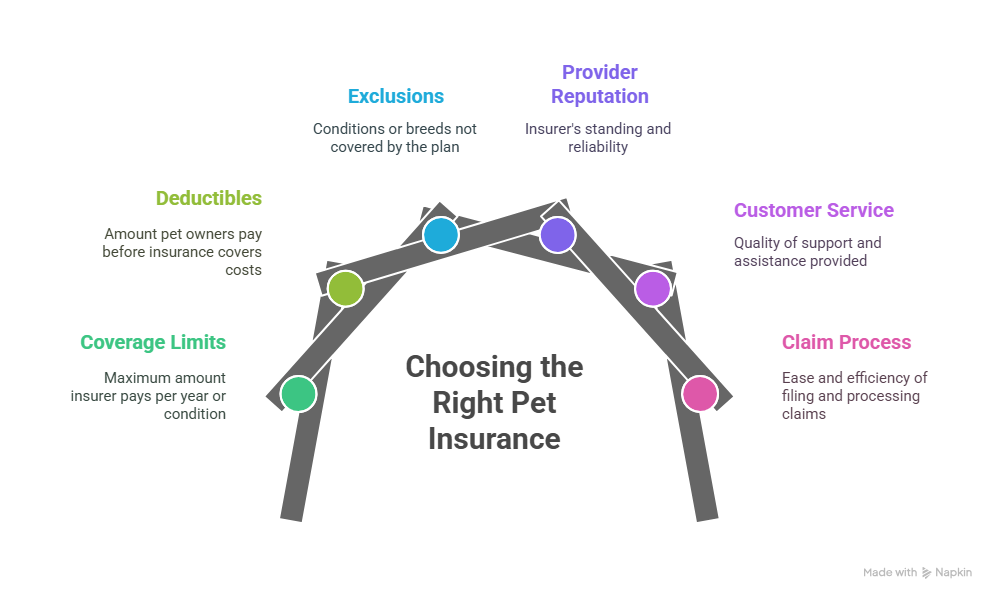

How to Evaluate and Compare Simple Plans

A number of considerations, like as coverage limitations, deductibles, and exclusions, must be taken into account when comparing basic plans. Pet owners should also consider the reputation, customer service, and claim procedure of the supplier.

- Coverage limits: Verify the highest sum that the insurance will pay annually or under certain circumstances.

- Deductibles: Take into account the annual or condition-specific deductible amount.

- Exclusions: Recognize what is not covered, such as certain breeds or pre-existing conditions.

Pet owners may choose a cost-effective pet insurance plan that suits their requirements and offers the greatest value for their money by carefully weighing these variables.

Unexpected Expenses and Factors

Pet owners should be aware of a number of hidden expenses and factors, even if $10 per month pet insurance could seem like a tempting choice.

Possible Out-of-Pocket Costs

Owners of pets should be aware that pet insurance policies that cost $10 per month sometimes have exorbitant deductibles and coverage restrictions, which may lead to substantial out-of-pocket costs.

For example, you may have to pay a high deductible before your insurance coverage begins if your cat needs surgery. A co-pay or coinsurance may also be included in certain plans, which might raise your costs.

| Expense Type | Description | Average Cost |

|---|---|---|

| Deductible | The amount you pay before insurance coverage begins | $100-$500 |

| Co-pay/Coinsurance | A percentage of the bill you pay after deductible | 10%-50% |

| Annual Limit | The maximum amount the insurance pays per year | $5,000-$20,000 |

Breed and Age Limitations

The fact that some pet insurance companies may have breed and age limits that may impact your pet’s eligibility for coverage is another important factor to take into account.

For instance, some insurance companies may not cover dogs that are older than a set age or breeds that are more likely to have particular health problems. Before making a purchase, it is crucial to check the policy conditions to make sure your pet qualifies.

- Verify the coverage’s age restrictions.

- Examine any limits or exclusions related to a breed.

- Recognize policies regarding pre-existing conditions.

Conclusion, is $10 pet insurance appropriate for your pet?

Selecting the best pet insurance may be difficult, particularly with so many alternatives on the market. Basic coverage is provided by the $10 per month pet insurance policies, but it’s important to know what they include. You may make an educated choice by taking into account variables like age, breed limitations, deductibles, and coverage limits.

It’s important to consider your pet’s unique demands while weighing your pet insurance alternatives. $10 pet insurance policies might be an excellent place to start if you’re searching for a cost-effective option. You may need to look into other solutions, however, if your pet needs more extensive coverage.

The choice to get $10 pet insurance ultimately comes down to your financial circumstances and the health requirements of your pet. You may choose a plan that offers your pet the ideal combination of price and coverage by analyzing the benefits and drawbacks of different pet insurance alternatives.

FAQ

What is considered affordable pet insurance?

Affordable pet insurance is typically defined as a policy that costs $10-$20 per month, offering basic coverage for accidents and illnesses, such as those provided by companies like Nationwide Pet Insurance and ASPCA Pet Health Insurance.

How does low-cost pet insurance work?

Low-cost pet insurance works by providing a basic level of coverage for your pet’s medical expenses, usually with a limited coverage amount, deductible, and co-pay, helping to offset the costs of unexpected veterinary bills.

What are the benefits of budget-friendly pet insurance?

The benefits of budget-friendly pet insurance include financial protection against unexpected veterinary expenses, peace of mind, and the ability to provide necessary medical care for your pet without breaking the bank, as seen with providers like PetPlan and Trupanion.

Are there any pet insurance options that cost around $10 a month?

Yes, some pet insurance companies, such as Fetch Pet Insurance and Lemonade Pet Insurance, offer basic plans starting at around $10 a month, although the coverage and limits may vary.

What is typically covered under a cheap pet insurance monthly cost plan?

A cheap pet insurance monthly cost plan usually covers basic expenses such as accidents, injuries, and sometimes illnesses, but may have limitations, exclusions, and higher deductibles, so it’s essential to review the policy details.

How do I choose the right pet insurance coverage for my pet?

To choose the right pet insurance coverage, consider factors such as your pet’s age, breed, health, and your budget, and compare different insurance providers, their coverage options, and costs to find the best fit for your needs.

Can I customize my pet insurance benefits?

Some pet insurance companies, like Healthy Paws Pet Insurance, offer customizable plans that allow you to tailor your coverage to your pet’s specific needs and your budget.

Are there any age or breed restrictions for pet insurance options?

Yes, some pet insurance providers have age or breed restrictions, so it’s crucial to check the policy details before purchasing, as certain breeds or older pets may be excluded or have limited coverage.